Data Assistance

Meaningful Data at the Local, State, and National Levels

National Priorities Project makes information about the federal budget accessible to citizens, journalists, and developers. We have several unique resources that breakdown federal budget data into categories and datasets that are meaningful at the local, state, and national levels.

Data Tools

Cost of National Security

Cost of National Security

What counts as national security depends on your perspective. Some people consider wars overseas to be national security. Others consider the U.S. military, fighter aircraft, and the American nuclear weapon stockpile to be national security. Some people consider giving weapons to other countries to be national security. After Sept. 11, 2001, we created the Department of Homeland Security and poured hundreds of billions of dollars into it, and some people consider that to be national security. Others think of national security as having enough to eat, a place to live, plus health care, clean air to breathe and water to drink, and access to an education. Whatever your perspective, we have running counters for you, tracking the cost of your national security.

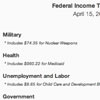

Personal Income Tax Receipt

Personal Income Tax Receipt

Each year prior to Tax Day, NPP breaks down your income tax dollar into 13 easy-to-understand spending categories. We then show you how each one of your income tax dollars was spent, to the penny, by the federal government. Our analysis includes how much of your income taxes were spent on nuclear weapons, the postal service, the Corporation for Public Broadcasting, and many more federal programs. This information can be downloaded and shared as a tax receipt.

Trade-Offs

Trade-Offs

NPP's Trade-Offs tool illustrates the local impact of the federal budget by quantifying federal spending in terms of real numbers that make sense to readers – such as number of teachers, number of households with renewable energy, or number of Head Start slots for children. This unique tool allows you to see how much money your state, county, city, or congressional district contributes to certain federal programs, and find out what you could buy instead if those dollars were allocated differently.