Clearing Up Tax Day Confusion

By

Mattea Kramer

Posted:

We’ve gotten lots of great e-mails and comments about Tax Day, which we launched on Friday. But there’s been some confusion about what’s included in our breakdown of your federal income tax dollar. There are two main sources of confusion: First, many people have written to ask why Tax Day looks different from the discretionary budget. And second, some folks erroneously thought that we combined payroll taxes with income taxes.

You can see the proposed discretionary budget in Federal Budget 101. Well over 50 percent of discretionary spending funds the military. However, as you saw in Tax Day, only 27 cents of every federal income tax dollar funds the military. Many people wrote to ask, How can that be?

Your federal income taxes become “federal funds” when they’re paid into the Treasury. It would be easy to assume that federal funds simply become discretionary spending. However, federal funds do not directly correspond with discretionary spending. Federal fund revenue is far greater than discretionary spending. Billions of federal fund dollars pay for programs in the mandatory budget, such as Medicare.

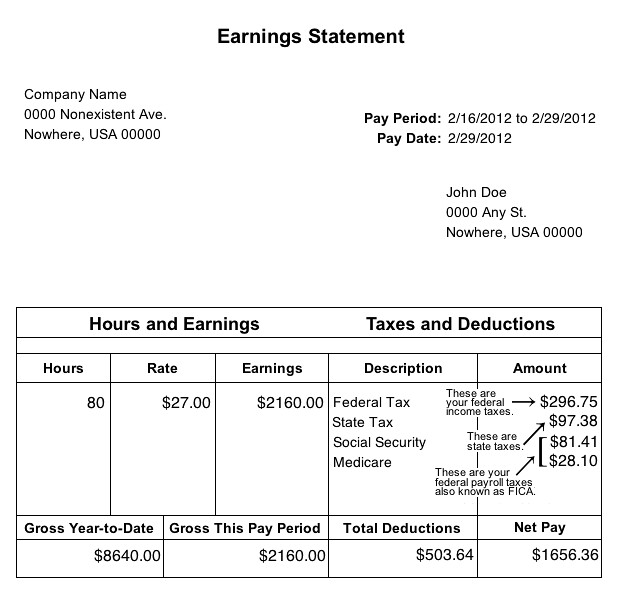

That leads us to the second point of confusion. On your paycheck, you can see your federal income taxes as separate from payroll taxes, which are also called FICA.

All of your payroll taxes fund Social Security and Medicare. But some federal income taxes also fund Medicare, and in 2011, some federal income taxes also funded Social Security. The Tax Day bar chart does not include payroll taxes. It only shows where income taxes were spent. But since some of your income taxes funded Medicare and Social Security in 2011, those two programs show up in Tax Day.

In most years, payroll taxes are sufficient to cover the costs of Social Security. But in 2011, the payroll-tax holiday reduced trust fund revenues, and as a result, some federal funds—your income taxes—went toward the Social Security program. Some experts worry that the payroll-tax holiday undermines the Social Security program, by compromising its dedicated funding source.