You Ask, We Answer: Why Is This Tax Receipt Different from the White House's?

By

Mattea Kramer

Posted:

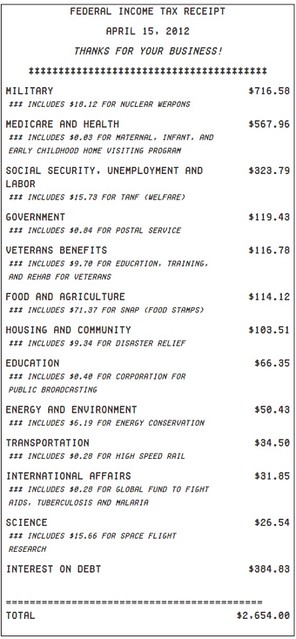

Tax day is a week away, and this year National Priorities Project writes you a receipt for how much you paid in federal income taxes-- so you can see exactly how much of your own 2011 income taxes went to the military, health programs, education, and everything else.

But some people are wondering why our tax receipt is different from ones put out by the White House and some other research organizations. The White House asks you how much you paid in federal income taxes, but it also asks how much you paid in Social Security taxes and in Medicare taxes. Then it shows you where all those taxes went.

But tax day isn't about Social Security and Medicare taxes. It's about your federal income taxes; that's what's due to the IRS every April. So at National Priorities Project, our tax day receipt only shows where the federal government spent your income taxes. And, throughout the whole rest of the year, we talk about where all taxes were spent. And we simply call that total federal spending.

Why does this distinction matter? Well, each year our elected officials must decide how to spend our income tax dollars. But they very rarely change the way Social Security and Medicare taxes are spent. So income taxes are a measure of our lawmakers' priorities. This year, 27 cents of every income tax dollar went to the military. Two cents went to education, and one penny went to science. Whether you agree with those priorities or not, it's important that you understand that those amounts reflect deliberate choices made in Washington.

Check out your own receipt here. This one shows how the federal government spent $2,654 in income taxes: