You Ask, We Answer: Fact Check on Social Security and the Deficit

By

Mattea Kramer

Posted:

|

Debt & Deficit,

Social Insurance, Earned Benefits, & Safety Net

Paul from Northampton, Mass., wrote in to ask: "Some politicians say Social Security in no way contributes to the deficit. But for the last two years Social Security expenditures have exceeded Social Security revenues. How does this not contribute to the deficit?" Good question, Paul.

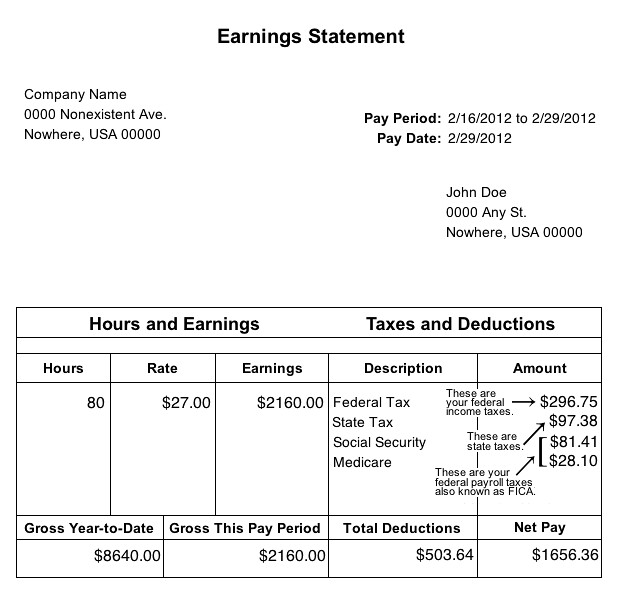

First, some key background. The Social Security program is funded with your payroll taxes:

Payroll taxes fund the Social Security program as well as part of Medicare. In most years, workers and employers each pay 6.2 percent of wages toward Social Security, and those taxes are usually more than enough to cover the whole cost of the Social Security program.

But then the Great Recession came, and as one way to buoy the weak economy, lawmakers passed the payroll-tax holiday, which reduced workers' Social Security tax down to 4.2 percent of their wages. (Employers still pay 6.2 percent.) That tax holiday will expire at the end of 2012.

But because of the temporary rate reduction, payroll tax revenue in 2011 and 2012 has not been sufficient to cover the costs of the program. And for that reason, some general fund revenue has funded Social Security. That general revenue mostly comes from your federal income taxes and government borrowing. In other words, because of the payroll-tax holiday, Social Security is temporarily contributing to the budget deficit. When the payroll-tax holiday expires at the end of the year, payroll taxes will once again cover the full cost of Social Security – and will continue to do so until around 2033.

Check out these key facts about Social Security to find out how lawmakers can keep the program's costs and funding in balance far beyond 2033, and why this is one of the few issues in which President Obama and Governor Romney agree.