Big Tax Breaks Equal Big Cash for the Top 1%

By

Mattea Kramer

Posted:

Source: OMB, CBO. Click here for the full, interactive version of these charts.

The tax code is so full of tax breaks that this year it will cost the federal government more than $1 trillion – as much as all discretionary spending in the federal budget. Tax breaks are all different kinds of credits, deductions, and exclusions that allow people to reduce the amount they owe in taxes. But not everyone benefits equally. The top 10 tax breaks – which total more than $750 billion this year – heavily benefit the top 1 percent of earners. For instance:

- The popular home mortgage interest deduction allows wealthy taxpayers to deduct the mortgage interest for second and third homes – and even yachts classified as homes. That deduction will cost the federal government around $93 billion this year, and 15 percent of that total will go to the top 1 percent.

- Taxpayers are allowed to deduct the amount they spend on state and local taxes from their federal tax liability, and that tax break will cost the federal government around $44 billion this year. Thirty percent of that total will go to the top 1 percent.

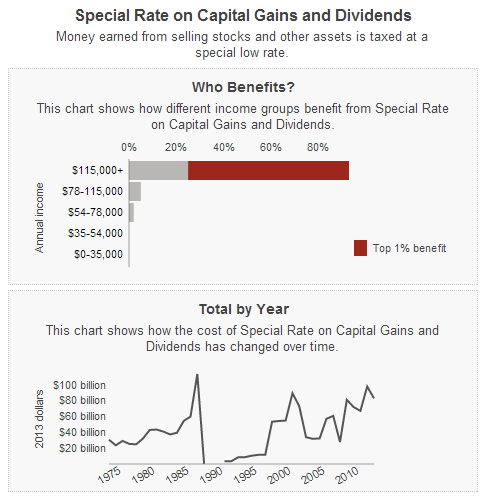

- There's a special low tax rate on capital gains and dividends that mean taxpayers pay a lower rate on investment income than on regular wages. That tax break will cost the federal government $83 billion this year, and a staggering 68 percent of that total will go to the top 1 percent.

Want more? Check our our interactive Big Money in Tax Breaks.